Earning Through Carbon Markets in Agriculture USA

Farmers across the United States are discovering new income opportunities through carbon markets in agriculture USA. By participating in carbon credit programs and payments for ecosystem services, U.S. farmers can earn money while adopting sustainable, climate-smart practices.

Thanks to the growth of carbon markets and payments for ecosystem services (PES), American farmers can now earn money for practices that help fight climate change. In this guide, we’ll explore how these innovative systems are reshaping agriculture in the U.S., how farmers can participate, and what trends to expect in 2025 and beyond.

How Carbon Markets Work in U.S. Agriculture

A carbon market allows companies or governments to buy and sell carbon credits — measurable units that represent a reduction or removal of greenhouse gases from the atmosphere.

Common Carbon-Sequestering Practices in U.S. Farms

In agriculture, carbon credits are generated when farmers adopt practices that sequester carbon in the soil or reduce emissions. These include:

- No-till or reduced tillage

- Cover cropping

- Rotational grazing

- Agroforestry

- Precision nutrient management

Each ton of carbon dioxide (CO₂) captured or avoided can be sold as a carbon credit in voluntary or compliance markets.

The Growing Economic Value of Carbon Credits in 2024

According to the World Bank’s 2024 State and Trends of Carbon Pricing Report, the global carbon market value reached over $104 billion, and agricultural participation is rapidly increasing in North America.

Key Benefits of Carbon Markets for U.S. Farmers

Carbon markets are transforming the economics of farming by creating a new revenue stream for regenerative and climate-smart practices.

Additional Farm Income

The USDA Climate-Smart Commodities Initiative estimates that farmers can earn $20–$40 per acre per year through carbon credit programs, depending on the type of practice and soil carbon potential.

Sustainable Branding and Market Advantage

Buyers and food companies are increasingly seeking low-carbon supply chains, rewarding farmers who can prove sustainable management.

Risk Reduction and Climate Resilience

Adopting carbon-smart practices like cover cropping improves soil health, reduces input costs, and builds resilience to droughts and floods — key climate risks facing U.S. agriculture.

Major Types of Carbon Markets in the United States

| Market Type | Description | Examples |

|---|---|---|

| Voluntary Market | Farmers sell credits to private companies aiming for net-zero goals. | Indigo Ag, Nori, Soil Carbon Co. |

| Compliance Market | Credits traded under regulated government schemes. | California Cap-and-Trade Program |

| Emerging Regional Programs | State or cooperative-level initiatives supporting local producers. | Midwest Climate Smart Coalition, Ecosystem Services Marketplace Consortium |

Government Support for U.S. Carbon Market Growth

According to USDA, more than $3 billion has been committed to support U.S. farmers adopting carbon-reducing practices by 2025.

Expanding Beyond Carbon: Payments for Ecosystem Services (PES)

Payments for Ecosystem Services (PES) go beyond carbon. They reward farmers for the broader environmental benefits their land provides — such as:

Environmental Benefits Recognized Under PES Programs

- Improved water quality

- Biodiversity conservation

- Soil erosion control

- Pollinator habitat creation

Key PES Programs Supporting American Farmers

- Conservation Reserve Program (CRP) – Pays farmers to remove environmentally sensitive land from production.

- Environmental Quality Incentives Program (EQIP) – Provides funding for conservation practices.

- Regional PES Pilots – States like Vermont and Oregon are testing local ecosystem service markets for farmers.

How U.S. Farmers Earn from Carbon and Ecosystem Programs

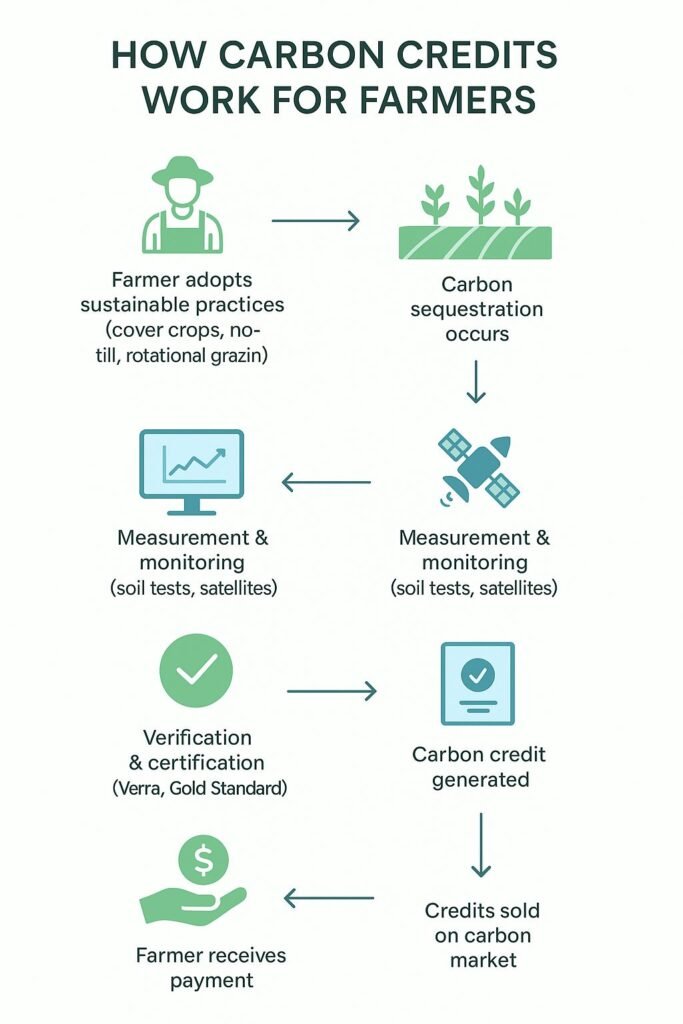

Step 1: Baseline Measurement

Farmers begin with a carbon or ecosystem assessment, measuring soil carbon levels, emissions, and land-use patterns.

Step 2: Practice Adoption

Choose verified practices such as reduced tillage, cover cropping, or rotational grazing that can generate measurable outcomes.

Step 3: Verification & Certification

Data is verified using standards like Verra, Gold Standard, or Climate Action Reserve, ensuring transparency and credibility.

Step 4: Credit Generation & Sale

Once verified, carbon credits are listed on platforms where corporations or investors purchase them to offset emissions.

Step 5: Payment & Reinvestment

Revenue is paid to farmers, who can reinvest in technology, soil testing, or precision agriculture to further improve sustainability.

Visual Overview of the Carbon Revenue Process

Step-by-step flowchart explaining how U.S. farmers can earn revenue through carbon markets in agriculture USA.

Midwest Case Study: How Farmers Earned from Carbon Markets

In 2024, a group of 120 farmers from Iowa and Illinois joined the Midwest Regenerative Carbon Network, adopting cover cropping and reduced tillage across 45,000 acres.

Within a year, they collectively generated 65,000 verified carbon credits, earning nearly $1.8 million in additional revenue — while also improving soil organic matter by 12%.

This case highlights how carbon markets not only benefit the environment but also increase farm profitability.

Challenges and Limitations of U.S. Carbon Markets

While promising, carbon markets are still evolving. Key challenges include:

- Measurement Uncertainty: Soil carbon sequestration varies across regions and time.

- Verification Costs: Third-party audits can be expensive for small farms.

- Market Volatility: Carbon prices fluctuate depending on global demand.

- Data Privacy: Farmers must share operational data for transparency.

Solutions Emerging to Overcome Carbon Market Barriers

The Environmental Defense Fund (EDF) notes that improved digital tools and remote sensing technologies are helping reduce verification costs and increase transparency.

Role of Technology in Scaling Carbon and PES Systems

Digital MRV Systems

Measurement, Reporting, and Verification (MRV) platforms like CIBO Impact and Agreena use satellite data to track soil carbon and land-use changes in real time.

AI and Blockchain Integration

AI-driven analytics improve accuracy in emission modeling, while blockchain ensures transparent credit transactions.

Precision Agriculture Tools

Sensors and IoT devices help farmers apply inputs efficiently, increasing both yield and carbon capture efficiency.

The World Economic Forum predicts that by 2030, smart farming technologies will double participation in voluntary carbon markets.

The Future of Carbon Markets and Ecosystem Payments in U.S. Agriculture

Carbon markets and ecosystem payment systems are moving toward greater integration, accessibility, and transparency.

Key Trends to Watch by 2025

- Increased farmer participation through digital MRV and low-cost verification

- Expansion of carbon-linked crop insurance products

- More corporate partnerships seeking farm-level offsets

- Growth of soil health-focused finance programs

In the long term, these initiatives will make sustainability profitable — rewarding farmers for being climate stewards.

Conclusion: A Profitable Path Toward Regenerative Agriculture

The transition to carbon-smart and ecosystem-focused farming isn’t just an environmental necessity — it’s a new business model for the future of U.S. agriculture.

By joining carbon markets and PES programs, American farmers can increase resilience, reduce risk, and create new revenue streams — all while restoring the planet’s natural balance.

In short, the more carbon you store in your soil, the more value you create — for your farm and the future of our food system.

Frequently Asked Questions (FAQ)

1. What are carbon markets in U.S. agriculture?

Carbon markets allow farmers to earn money by adopting climate-smart practices that reduce or capture greenhouse gas emissions. These practices generate carbon credits, which can be sold to companies seeking to offset their emissions.

2. How much can farmers earn from carbon credits?

On average, farmers in the U.S. can earn between $20 and $40 per acre per year, depending on soil type, farming practices, and carbon sequestration potential.

3. Are carbon markets regulated by the government?

Some carbon markets are voluntary, while others, like California’s Cap-and-Trade Program, are regulated. Farmers can participate in either, depending on their goals and eligibility.

4. What are Payments for Ecosystem Services (PES)?

PES programs pay farmers not only for carbon sequestration but also for improving biodiversity, soil health, and water quality—creating multiple income opportunities beyond carbon credits.

5. What are the main challenges for farmers?

Verification costs, data transparency, and market price fluctuations are major hurdles. However, new digital MRV tools and blockchain systems are helping reduce these challenges.

Final Thoughts

Carbon markets and ecosystem payment programs are reshaping U.S. agriculture — turning sustainability into a profitable opportunity.

By adopting regenerative and carbon-smart practices, farmers can strengthen their soil, reduce risks, and earn steady income while contributing to climate action.

In essence, every ton of carbon stored in your soil is not just good for the planet — it’s valuable for your farm and future generations.

Last revised: November 2025

(This article was updated to include the latest 2025 data, programs, and market trends in U.S. agricultural carbon markets.)

Related Reading and Further Insights

To learn more about modern agricultural technologies, check out our guide on Smart Farming Technologies Transforming UK Agriculture.

For eco-friendly nutrient management, see Organic Fertilizer vs Chemical Fertilizer: What Works Better for Your Garden in 2025?.

And explore profitable sustainability ideas in Tomato Farming in Canada: How to Grow Commercially.